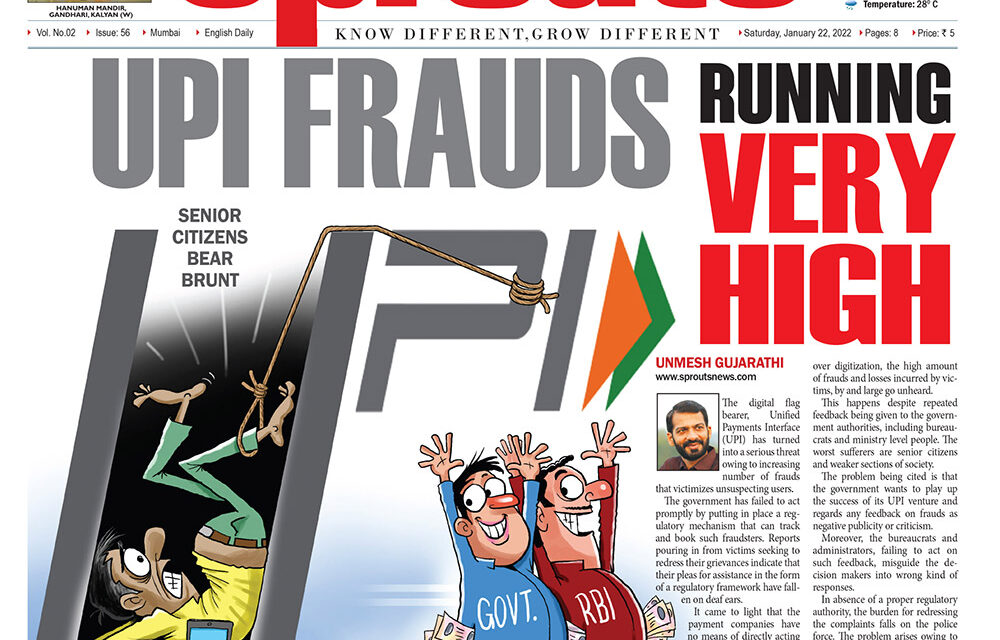

The digital flag bearer, Unified Payments Interface (UPI) has turned into a serious threat owing to increasing number of frauds that victimizes unsuspecting users.

The government has failed to act promptly by putting in place a regulatory mechanism that can track and book such fraudsters. Reports pouring in from victims seeking to redress their grievances indicate that their pleas for assistance in the form of a regulatory framework have fallen on deaf ears.

It came to light that the payment companies have no means of directly acting on such frauds. Only banks are mandated to report and track the misuse of the digital system.

However, banks don’t pursue such frauds on grounds that it’s for the regulator to act. Consequently, while the government goes on its chest thumping mode over digitization, the high amount of frauds and losses incurred by victims, by and large go unheard.

This happens despite repeated feedback being given to the government authorities, including bureaucrats and ministry level people. The worst sufferers are senior citizens and weaker sections of society.

The problem being cited is that the government wants to play up the success of its UPI venture and regards any feedback on frauds as negative publicity or criticism.

Moreover, the bureaucrats and administrators, failing to act on such feedback, misguide the decision makers into wrong kind of responses.

In absence of a proper regulatory authority, the burden for redressing the complaints falls on the police force. The problem arises owing to the police being ill equipped to handle digital frauds over UPI transactions. A senior police officer pointed out that it’s similar to a situation they faced when criminals started using mobile phones. It took the police quite some time before they were able to track and book the gangsters.

As of now, it’s being pointed out that the government’s refusal to act on feedback from victims might act as a self goal.