A host of banks have been forced to seek rescue measures from either the banking regulator, RBI or in some instances the government’s cash cow, namely LIC in the recent past, after registering very high NPAs.

The list of names also includes Yes Bank that sought financial assistance from the relatively healthy SBI bank. The other high-NPA banks that feature in the sick list are IDBI and RBL. The banks like CKP Bank, Karnala bank, City Co-op bank, Karad Janta bank and Priyadarshini bank have already been wound up.

As for the PMC Bank, the RBI has extended the restrictions till March 31,2022, The RBI had taken over the board of PMC Bank in September 2019 after finding major financial irregularities in the bank.

While RBL bank is being buffered by the RBI, LIC has been roped in to save IDBI from its financial crunch situation. As the number of banks that are suffering from glut of funds owing to bad loans and write-offs of massive borrowings are on the increase, it is the tax payers who have to bear the burden for such irresponsible lending.

Our Sprouts’ Special Investigative Team (SIT) is bringing to light the story of RBL that looks to be in the docks despite failure on part of the authorities to confirm its exact financial status.

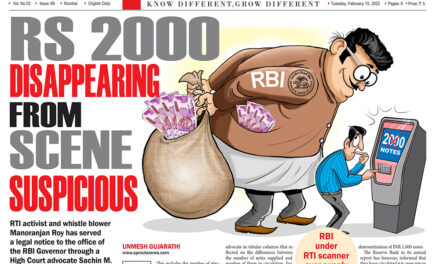

The SIT also learnt that such repeated disasters in the banking sector happen right under the eyes of the regulator, namely RBI, which fails to intervene in a timely manner and put an end to fiscal indiscipline. The RBI, it has been observed, steps in too late after much of the financial damage done turns irreparable.

Taking the focus to the case in hand, namely RBL, it has been reliably learnt by our SIT that the bank pursued unsafe retail lending in a big way to boost its volume of trade. In the process, a steep hike in the number of bad loans that merit being deemed as NPAs might spell doom in the near future.

IS RBI SLEEPING?

Is RBI sleeping over NPA ?

RBI in a deep slumber, while NPA ruins economy

RBI losing trust in banks

RBI fails to rein in on high NPA banks

Govt. ropes in LIC to buffer bad loans

RBL bank likely to join the list of defaulters

Tax payers forced to bear this burden

Big sharks go scot free, common men in a soup

Dithering stand of RBI about NPA banks

High NPA banks bailed out, tax payers bear the brunt

One day the RBI itself will be a defaulter

RBI in a bind due to the NPA banks