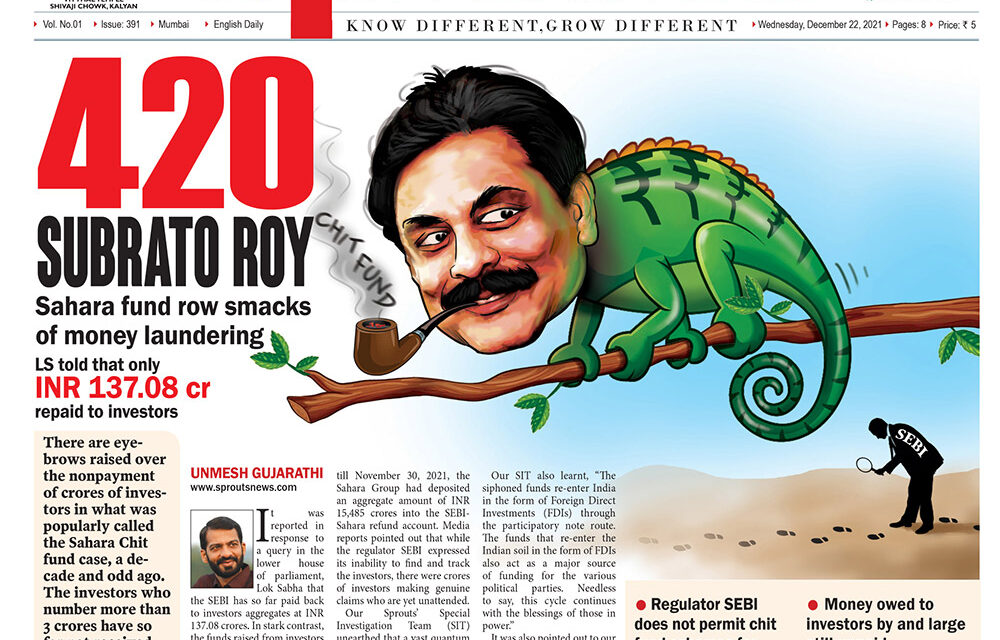

It was reported in response to a query in the lower house of parliament, Lok Sabha that the SEBI has so far paid back to investors aggregates at INR 137.08 crores. In stark contrast, the funds raised from investors by the two Sahara Group companies, namely Sahara India Real Estate Corp Ltd (SIRECL) and Sahara Housing Investment Corp Ltd (SHICL) runs into 25,781.37 crores.

Interestingly, the Lok Sabha was informed that till November 30, 2021, the Sahara Group had deposited an aggregate amount of INR 15,485 crores into the SEBI-Sahara refund account. Media reports pointed out that while the regulator SEBI expressed its inability to find and track the investors, there were crores of investors making genuine claims who are yet unattended.

Our Sprouts’ Special Investigation Team (SIT) unearthed that a vast quantum of investors’ funds that were raised by the Sahara Group companies have vanished. The scheme of things follows a set modus operandi. Funds get siphoned through the hawala route to tax havens like Mauritius or Caveman Islands.

Our SIT also learnt, “The siphoned funds re-enter India in the form of Foreign Direct Investments (FDIs) through the participatory note route. The funds that re-enter the Indian soil in the form of FDIs also act as a major source of funding for the various political parties. Needless to say, this cycle continues with the blessings of those in power.”

It was also pointed out to our SIT that there were plenty of spurious investor names that existed only on paper. These names were used as proxy for the money Sahara’s group companies received from big time politicians and black money hoarders as well.

Regulator SEBI does not permit chit fund schemes for listed companies

Sahara’s violation of SEBI norms stirred a hornet’s net

Money owed to investors by and large still unpaid

Crores of poor investors have no means to succor