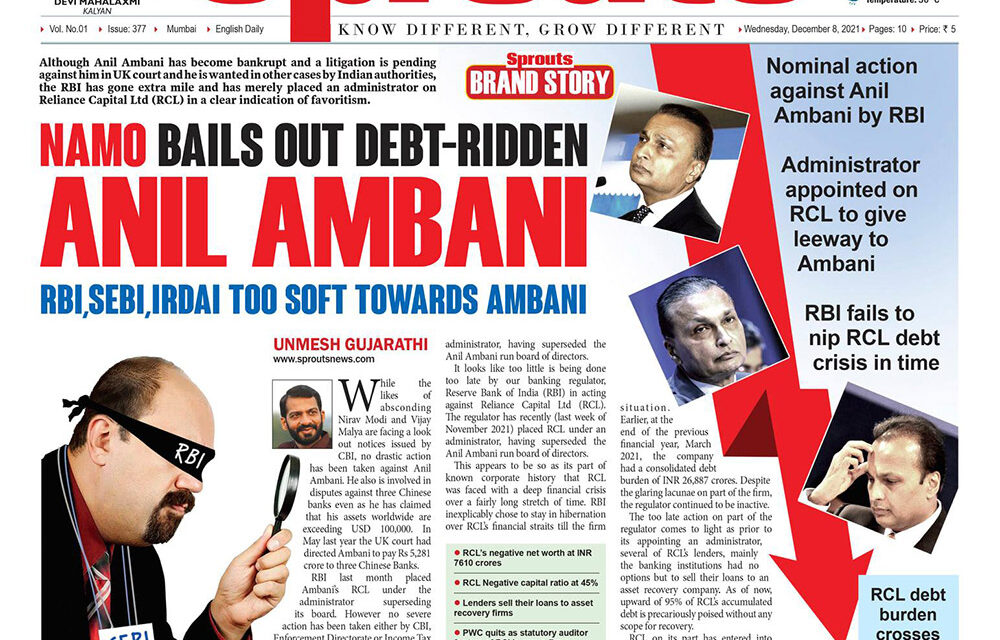

While the likes of absconding Nirav Modi and Vijay Malya are facing a look out notices issued by CBI, no drastic action has been taken against Anil Ambani. He also is involved in disputes against three Chinese banks even as he has claimed that his assets worldwide are exceeding USD 100,000. In May last year the UK court had directed Ambani to pay Rs 5,281 crore to three Chinese Banks.

RBI last month placed Ambani’s RCL under the administrator superseding its board. However no severe action has been taken either by CBI, Enforcement Directorate or Income Tax in the multi crore rupees financial fraud.

It looks like too little is being done too late by our banking regulator, Reserve Bank of India (RBI) in acting against Reliance Capital Ltd (RCL). The regulator has recently (last week of November 2021) placed RCL under an administrator, having superseded the Anil Ambani run board of directors.

It looks like too little is being done too late by our banking regulator, Reserve Bank of India (RBI) in acting against Reliance Capital Ltd (RCL). The regulator has recently (last week of November 2021) placed RCL under an administrator, having superseded the Anil Ambani run board of directors.

This appears to be so as its part of known corporate history that RCL was faced with a deep financial crisis over a fairly long stretch of time. RBI inexplicably chose to stay in hibernation over RCL’s financial straits till the firm accumulated a negative net worth of INR 7610 crores.

Besides, its negative capital ratio stood at 45% at the point of time the RBI chose to move in and take control of the situation. Earlier, at the end of the previous financial year, March 2021, the company had a consolidated debt burden of INR 26,887 crores. Despite the glaring lacunae on part of the firm, the regulator continued to be inactive.

The too late action on part of the regulator comes to light as prior to its appointing an administrator, several of RCL’s lenders, mainly the banking institutions had no options but to sell their loans to an asset recovery company. As of now, upward of 95% of RCL’s accumulated debt is precariously poised without any scope for recovery.

RCL on its part has entered into litigation against the recovery action initiated against the firm by its debenture trustees. Well in advance of this sorry state of affairs having resulted, Price Waterhouse & Co (PWC) caused the amber lights to blink.

Citing non-compliance with the observations that it had made, PWC in 2019 resigned from acting as the statutory auditor of two of RCL’s group companies, namely Reliance Capital and Reliance Home Finance. Barring political interference causing intimidation the RBI has no excuse for ignoring the red flag raised by PWC.

RBI has finally superseded the board of Anil Ambani run Reliance Capital Ltd (RCL) and placed it under an administrator. This action has been coming for a long time, but regulators it seems have moved at glacial speed.

RCL’s negative net worth at INR 7610 crores

RCL Negative capital ratio at 45%

Lenders sell their loans to asset recovery firms

PWC quits as statutory auditor for two of RCL’s group firms