A former secretary to the government of India, EAS Sarma has raised serious questions on the Centre’s current proposal intended to disinvest the public sector behemoth, LIC. The ministry of finance (MoF) is paving the way for LIC’s disinvestment by coming out with an initial public offering (IPO).

Sarma in his vehemently worded letters addressed to the MoF has sought an urgent rethinking on the proposal, seeking that the disinvestment process of LIC as well as other Central Public sector enterprises be immediately put on hold.

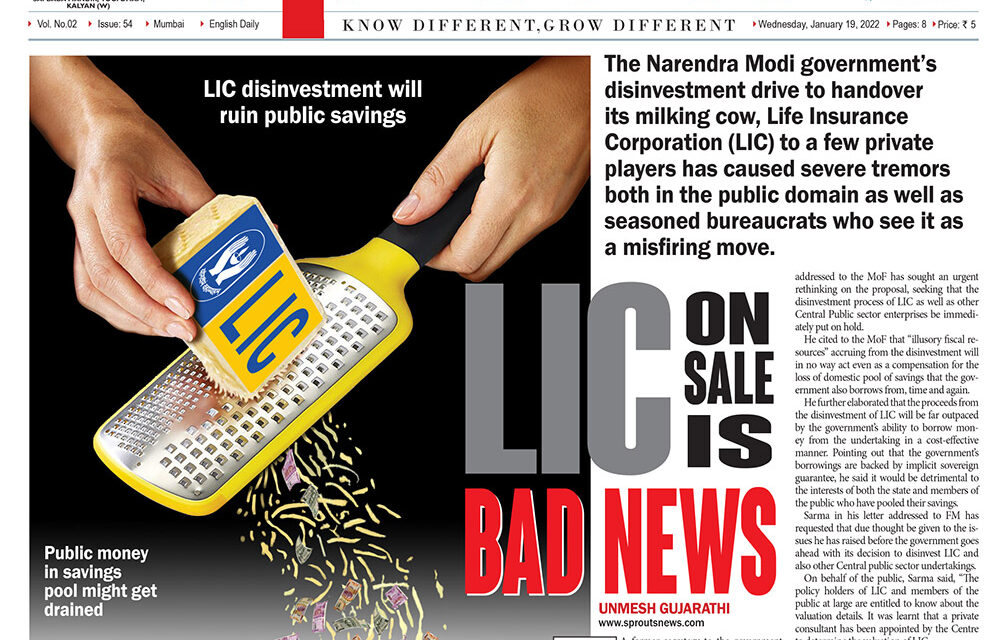

He cited to the MoF that “illusory fiscal resources” accruing from the disinvestment will in no way act even as a compensation for the loss of domestic pool of savings that the government also borrows from, time and again.

He further elaborated that the proceeds from the disinvestment of LIC will be far outpaced by the government’s ability to borrow money from the undertaking in a cost-effective manner. Pointing out that the government’s borrowings are backed by implicit sovereign guarantee, he said it would be detrimental to the interests of both the state and members of the public who have pooled their savings.

Sarma in his letter addressed to Nirmala Sitharaman has requested that due thought be given to the issues he has raised before the government goes ahead with its decision to disinvest LIC and also other Central public sector undertakings.

On behalf of the public, Sarma said, “The policy holders of LIC and members of the public at large are entitled to know about the valuation details. It was learnt that a private consultant has been appointed by the Centre to determine the valuation of LIC.

Reports also mentioned that the estimated value of the public issue stood at INR 15 lakh crores and the aggregate insurance interests of members of the public or embedded value stood at INR 4 lakh crores.

Stating that the actual figures might be way off mark from what is being learnt by unofficial sources, he termed it as a vitiation of transparency in governance.

LIC disinvestment will ruin public savings

Govt. stands to be a loser in this case

People have right to know the terms

Centre needs to ponder on this move

Few private investors to buy dirt-cheap stakes

People at large will get fooled by such a bid

Public money in savings pool might get drained