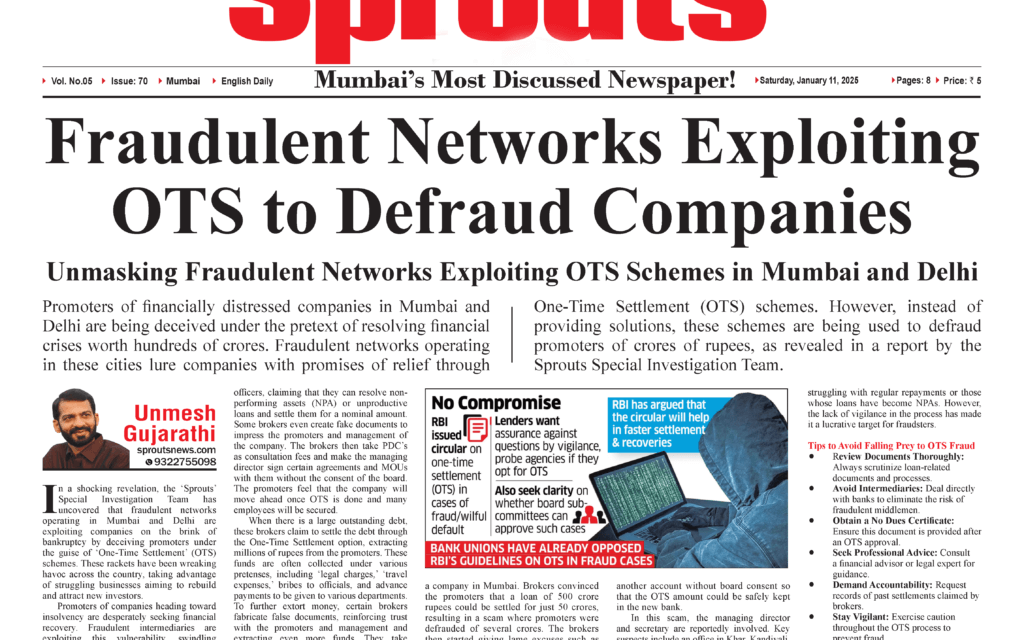

Unmasking Fraudulent Networks Exploiting OTS Schemes in Mumbai and Delhi

UnmeshGujarathi | Sprouts Exclusive

Promoters of financially distressed companies in Mumbai and Delhi are being deceived under the pretext of resolving financial crises worth hundreds of crores. Fraudulent networks operating in these cities lure companies with promises of relief through One-Time Settlement (OTS) schemes. However, instead of providing solutions, these schemes are being used to defraud promoters of crores of rupees, as revealed in a report by the Sprouts Special Investigation Team.

In a shocking revelation, the ‘Sprouts’ Special Investigation Team has uncovered that fraudulent networks operating in Mumbai and Delhi are exploiting companies on the brink of bankruptcy by deceiving promoters under the guise of ‘One-Time Settlement’ (OTS) schemes. These rackets have been wreaking havoc across the country, taking advantage of struggling businesses aiming to rebuild and attract new investors.

Promoters of companies heading toward insolvency are desperately seeking financial recovery. Fraudulent intermediaries are exploiting this vulnerability, swindling millions of rupees by deceiving these promoters.

These conmen entice promoters and managing directors with grand promises, pretending to have connections with bank chief executive officers and various ministry officers, claiming that they can resolve non-performing assets (NPA) or unproductive loans and settle them for a nominal amount. Some brokers even create fake documents to impress the promoters and management of the company. The brokers then take PDC’s as consultation fees and make the managing director sign certain agreements and MOUs with them without the consent of the board. The promoters feel that the company will move ahead once OTS is done and many employees will be secured.

When there is a large outstanding debt, these brokers claim to settle the debt through the One-Time Settlement option, extracting millions of rupees from the promoters. These funds are often collected under various pretenses, including ‘legal charges,’ ‘travel expenses,’ bribes to officials, and advance payments to be given to various departments. To further extort money, certain brokers fabricate false documents, reinforcing trust with the promoters and management and extracting even more funds. They take the Managing Director and Secretary in confidence and brainwash them by saying this is the only way to settle.

A confidential report shared with ‘Sprouts’ Special Investigation Team highlights how such a fraud occurred with a company in Mumbai. Brokers convinced the promoters that a loan of 500 crore rupees could be settled for just 50 crores, resulting in a scam where promoters were defrauded of several crores. The brokers then started giving lame excuses such as the balance sheet is not proper, the banks are not listening rest all other banks in the consortium are ready, or one excuse or other when they are asked for an OTS letter. Nearly they pull one year or other for the same and advice the company to open another account without board consent so that the OTS amount could be safely kept in the new bank.

In this scam, the managing director and secretary are reportedly involved. Key suspects include an office in Khar, Kandivali, and Worli individuals from BKC.

Understanding the OTS Scheme

The One-Time Settlement (OTS) facility is designed to help borrowers clear their outstanding debts by paying a lump sum amount. It is often offered to borrowers struggling with regular repayments or those whose loans have become NPAs. However, the lack of vigilance in the process has made it a lucrative target for fraudsters.

Tips to Avoid Falling Prey to OTS Fraud

- Review Documents Thoroughly: Always scrutinize loan-related documents and processes.

- Avoid Intermediaries: Deal directly with banks to eliminate the risk of fraudulent middlemen.

- Obtain a No Dues Certificate: Ensure this document is provided after an OTS approval.

- Seek Professional Advice: Consult a financial advisor or legal expert for guidance.

- Demand Accountability: Request records of past settlements claimed by brokers.

- Stay Vigilant: Exercise caution throughout the OTS process to prevent fraud.

Fraudulent activities in the name of OTS schemes have become a growing menace, exploiting the desperation of struggling businesses. Awareness and diligence are crucial to safeguarding companies from such scams.

Unmesh Gujarathi

Editor in Chief

sproutsnews.com

epaper.sproutsnews.com

businessnews1.com

moneynews1.com

https://www.facebook.com/unmesh.gujarathi.1/

twitter.com/unmeshgujarathi

https://www.linkedin.com/in/unmesh-gujarathi-4125481a/

Contact No.: 9322 755098

Email Id: unmeshgujarathi@gmail.com / news@sproutsnews.com